France’s retirement pension system is a pay-as-you-go two-tier compulsory system segmented by professions. It thus comprises about 30 different schemes, even though some rules apply to all of them (e.g. the legal retirement age). It is financed by social contributions levied on employers, employees and self-employed persons and increasingly by taxes. Since 1993, the pension system has been reformed several times by governments of various shades. These reforms have been met reluctantly or with broad acceptance. They have initiated a convergence of rules between the various schemes, which has yet to be completed, and led to a sharp slowdown in the growth of spending. Some of their effects have yet to unfold. However the imbalance of the pension system (whose expenditure make up around 14% of GDP) will require further adjustments in the future, by pushing back retirement ages or by reducing the level of pensions in relation to income from work. Even though national pension systems have their own historical, social and economic background, they face common challenges of financial sustainability, fair treatment between social groups and generations and increase in rates of employment, especially of the fifty- and sixty-year-old age groups. In view of these challenges, France’s

experience in this field of social reform might be of interest for other countries.

Date of the lecture

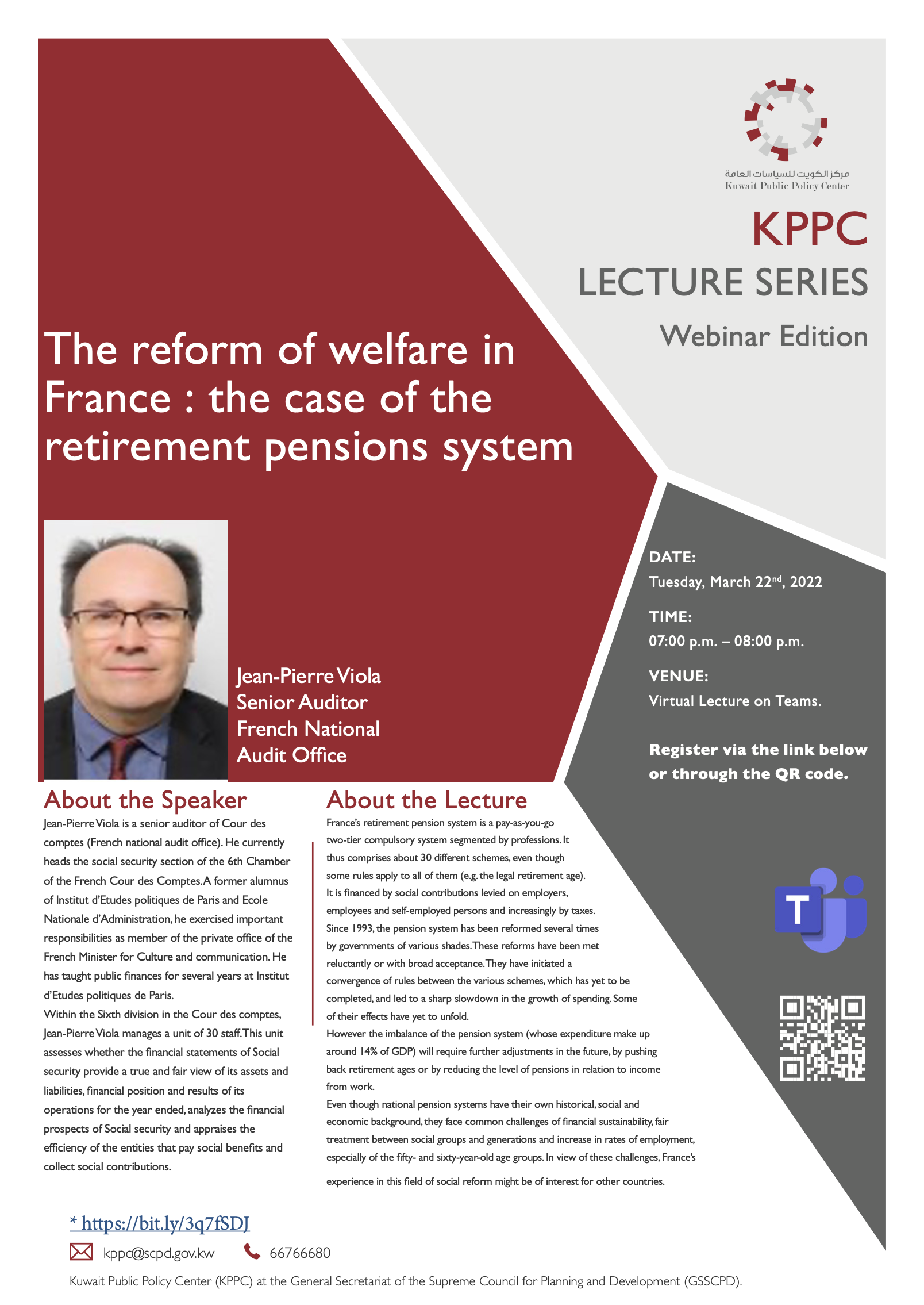

Lecturer

Jean-Pierre Viola